Choosing the right forex pairs to trade is one key factor that can significantly impact your success. This article will guide you through the best Forex pairs to trade and help you make the most of your trading strategy.

Do you know that the US dollar is involved in more than 50% of transactions on the forex market? Out of the US dollar currency pairs, the EURUSD is the world’s most traded currency pair, accounting for almost 30% of all forex trades.

Traders like these currency pairs because they are more liquid and have better trading conditions than other pairs.

However, beginner traders often wonder what are the best forex pairs to trade on the market. Some of them try to trade all of the currency pairs in the trading terminal, but this is fundamentally wrong.

Today, I’ll talk about the most traded currency pairs in the forex market, the best currency pairs to trade for beginners, and which ones should be avoided.

What is a Currency Pair?

Each currency can be abbreviated to 3 letters in accordance with the ISO 4217 standard. This standard selects the first two letters in the currency abbreviation from the country of origin and the last letter from the currency denomination.

For example, the US dollar USD consists of the first two letters of the country – USA and the name of the currency – Dollar.

However, there are a few exceptions.

For example, the currency MXN, which is the Mexican peso. Here MX comes from Mexico, but the name of the currency is indicated by the letter N.

Here is a list of major forex currencies and their abbreviations:

- USD – US dollar

- EUR – Euro

- GBP – British pound

- CHF – Swiss franc

- JPY – Japanese yen

- AUD – Australian dollar

- NZD – New Zealand dollar

- CAD – Canadian dollar

- RUB – Russian ruble

- CNY – Chinese yuan

- MXN – Mexican peso

A currency pair, as the name implies, consists of two currencies that express the ratio of the prices of these currencies to each other in the market, or in simple words, the exchange rate. When buying one currency on Forex, a trader simultaneously sells another. In this case, the first currency in the pair is the base currency, and the second is the quoted currency.

For example, in the EURUSD currency pair, the base currency is the euro, and the quoted currency is the US dollar. The EURUSD rate shows how many US dollars can be purchased for 1 euro. By opening a buy order for the EURUSD currency pair, you buy euros by paying in dollars. When you open a sell order, you sell euros and receive dollars in return.

The International Organization for Standardization (ISO) decides which currency will be considered the base and which is quoted.

Types of Currency Pairs

Forex currency pairs are divided into major, minor (cross-currency), and exotic currencies. Major pairs are the most liquid currency pairs, accounting for more than 80% of the trading volume in the foreign exchange market:

- EURUSD

- USDJPY

- GBPUSD

- AUDUSD

- USDCHF

- NZDUSD

- USDCAD

As you can see, they have one common factor – this is the US dollar, and other currencies belong to the Eurozone and the US partner countries for the export of natural resources and technologies.

If you remove the US dollar from the list of major currency pairs and cross them with each other, then you get minor or cross-currency pairs:

- EURGBP

- EURAUD

- GBPJPY

- CHFJPY

- NZDJPY

- GBPCAD

- EURJPY

- CADJPY

- EURCAD

- GBPCHF

Exotic currency pairs are relatively illiquid pairs and have very wide spreads as a result of their illiquidity. These pairs are usually the Swedish, Danish and Norwegian krone, South African rand, Turkish lira, and Mexican peso currency pairs.

- USDSEK

- USDNOK

- USDRUB

- EURTRY

- USDTRY

- USDSEK

- USDDKK

- USDZAR

- USDHKD

- USDSGD

- USDMXN

These lists are by no means exhaustive. On your Forex trading platform, you are likely to see more minor and exotic currency pairs than listed here.

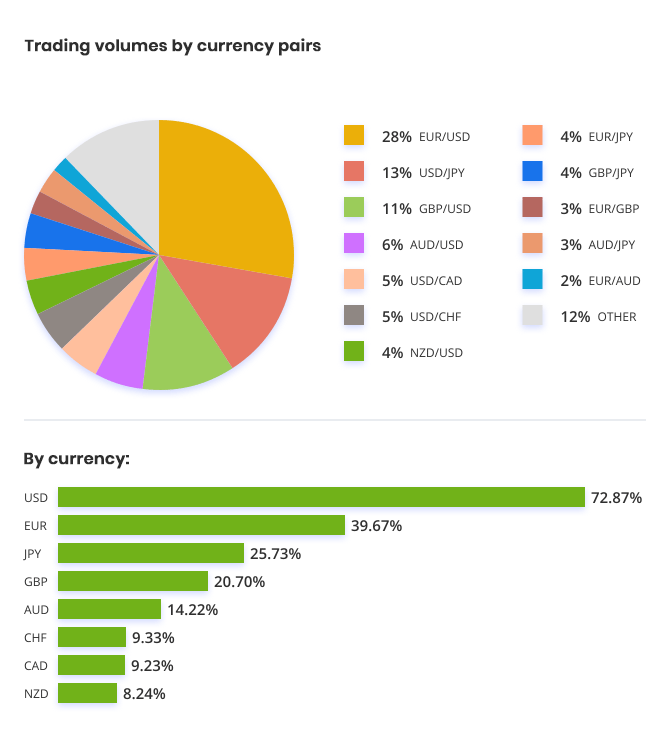

Most Traded Currency Pairs

Here are the most traded currency pairs by trading volume and currency.

Best Forex Pairs to Trade

I strongly recommend that beginners only start trading major currency pairs, as they have a low spread, easy to analyze and make predictions.

The major Forex pairs are the most traded currency pairs in the world, and they all include the US dollar. They are typically the most liquid and have the smallest spreads, making them an excellent choice for beginners and experienced traders alike.

At first, it is generally better to give your attention on two or three currency pairs and not be sprayed on all pairs. This way, you will not miss a signal, you will be able to close a deal if something went wrong quickly, and your deposit will be able to withstand small drawdowns.

Over time, as you gain some experience, you can add cross-currency pairs such as EURJPY, GBPJPY, and EURGBP, but remember that they have a high spread, which means they are not suitable for scalping.

I recommend excluding exotic currency pairs from trading altogether. They are more suitable for experienced traders. They have an even higher spread and swap. They can be traded only if there is an informational reason or during a regular price movement from one level to another for a long period of time.

Here are the best currency pairs to trade for beginner traders.

EURUSD – Euro/American Dollar

The EURUSD is the most traded currency pair in the Forex market and has the most liquidity. The latest data from the Bank for International Settlements (BIS) shows that EURUSD accounts for 23% of the total daily trading volume in the Forex market. Due to the volume of trading and the amount of money that goes into trading EURUSD, this pair has the lowest spreads in Forex. The intraday trading range for EURUSD is 100 pips on average.

Characteristics of the EURUSD currency pair:

- Average broker spread: 0-2 pips

- Average daily trading range: 90-100 pips

- Best time to trade: London and New York sessions (06:00 GMT – 16:00 GMT)

The following factors affect the movement of the EURUSD pair:

- Interest rate statements/action by the European Central Bank (ECB)

- Interest rate adjustments/statements by the US Federal Reserve

- Sovereign debt problems in some Eurozone countries (Greece, Ireland, Portugal, Italy, and Spain)

- Crude oil prices (affect USD)

Trading the EURUSD Currency Pair

EURUSD can be traded by both experienced and new traders. EURUSD has a reasonable intraday range, so it is suitable for day trading as well as scalping and intraday trading. EURUSD can be traded using technical and fundamental analysis. It trades very actively in the London and New York sessions, so it lends itself to reacting to important news releases coming out of the US and Eurozone. Always check the economic news calendar for the schedule of these news.

It is also important to keep an eye on the EURUSD currency correlations. It correlates positively with GBPUSD and negatively correlates with USDCHF. Comparing these charts may indicate arbitrage trading opportunities for EURUSD.

USDJPY – US Dollar/Japanese Yen

USDJPY is the second most traded currency pair in the Forex market, with a daily trading volume accounting for 17.7% of total Forex trading volume according to the Bank for International Settlements (BIS). For five-digit brokers, USDJPY quotes have three decimal places, while four-digit brokers have two.

Characteristics of the USDJPY currency pair:

- Average broker spread: 2-3 pips

- Average daily range: 50-100 pips

- Best time to trade: Asian trading session (00:00 GMT – 09:00 GMT). It may also be active during the release of NFP and major US retail sales (New York Session)

The following factors affect the movement of the USDJPY pair:

- Foreign exchange interventions by the Bank of Japan

- Quantitative Easing Announcements

- Trade and employment related news from the United States such as the Non-Farm Payrolls report and the Major Retail Sales report

- To a small extent, crude oil prices

- Natural disasters affecting New Zealand

Trading USDJPY Currency Pair

USDJPY should not be traded by novice traders until they have attained some degree of demo trading experience with news releases affecting the JPY. USDJPY trading is suitable for those practicing swing and position trading. USDJPY is marked with low daily ranges. It is not very suitable for range trading when the currency pair is in consolidation.

GBPUSD – British Pound/US Dollar

GBPUSD ranks third in the ranking of currency pairs in terms of the daily trading volume. A report from the Bank for International Settlements (BIS) shows that GBPUSD accounts for 9.2% of the total daily trading volume.

Characteristics of the GBPUSD currency pair:

- Average broker spread: 2-3 pips. The spread may increase periodically as important news releases

- Average daily range: 150-200 pips

- Best time to trade: Trading sessions in London and New York (07:00 GMT – 17:00 GMT)

The movement of the GBPUSD pair is influenced by the following factors:

- Adjustments to the quantitative easing program by the Bank of England

- Major UK news such as industry and employment data and inflation data (including BoE inflation letter)

- Bank of England (BoE) interest rate decision

Trading the GBPUSD Currency Pair

GBPUSD has a positive correlation with EURUSD and tends to increase any movement on EURUSD. Trading GBPUSD requires a little experience. The currency pair is well suited for intraday trading and scalping due to its large intraday range. High volatility is observed during news releases in the UK and at the opening of the New York session. GBPUSD is known for its erratic moves in the middle of news trading.

AUDUSD – Australian Dollar/US Dollar

The AUDUSD currency pair is the fourth most traded currency pair in the Forex market with a daily trading volume of 5.2% of total Forex trading volume according to the Bank for International Settlements (BIS).

Characteristics of the AUDUSD currency pair:

- Average broker spread: 2-4 pips

- Average daily range: 50-80 pips

- Most active trading sessions: Sydney, London, and New York

- Best time to trade: Asian trading session (00:00 GMT – 09:00 GMT)

The following factors affect the movement of the AUDUSD pair:

- AUD is a commodity currency. Thus, it is very sensitive to commodity prices, especially gold and copper

- Most of Australia’s exports go to China. Therefore, news from China, which borders on GDP, industrial data, retail sales, and employment, directly affects AUDUSD

- Australian housing data has a big impact on AUDUSD

- Interest rate decisions from the Reserve Bank of Australia (RBA)

Trading the AUDUSD Currency Pair

AUDUSD is well suited for novice traders due to its slow movements. At some point, it was used to carry trading. AUDUSD is characterized by a slow but steady reaction to major news releases.

Conclusion

Now you know the best forex pairs to trade on the forex market, what types they are divided into, and what currency pairs are best for beginners to trade. In conclusion, the best currency pairs to trade largely depend on your knowledge, experience, and risk tolerance. Major pairs like EUR/USD, USD/JPY, and GBP/USD are often preferred for their high liquidity and lower spreads. However, exploring minor and exotic pairs can also provide unique trading opportunities. Ensure you understand the various factors influencing Forex pairs and align your trading strategy accordingly.